Fascination About Clark Wealth Partners

Clark Wealth Partners Can Be Fun For Anyone

Table of ContentsAbout Clark Wealth PartnersGetting The Clark Wealth Partners To WorkThe Clark Wealth Partners PDFsAbout Clark Wealth PartnersFascination About Clark Wealth Partners

Merely put, Financial Advisors can handle component of the duty of rowing the boat that is your monetary future. A Financial Expert should deal with you, except you. In doing so, they must function as a Fiduciary by placing the most effective interests of their clients over their own and acting in good faith while supplying all relevant facts and avoiding disputes of rate of interest.Not all partnerships are effective ones. Potential downsides of dealing with an Economic Advisor include costs/fees, quality, and potential abandonment. Cons: Costs/Fees This can easily be a favorable as high as it can be an adverse. The trick is to make sure you get what your pay for. The claiming, "rate is an issue in the lack of worth" is precise.

Genuinely, the goal must be to feel like the guidance and service received deserve greater than the expenses of the relationship. If this is not the case, after that it is an unfavorable and thus time to reconsider the relationship. Disadvantages: High Quality Not all Financial Advisors are equivalent. Equally as, not one advisor is perfect for every possible client.

Some Known Incorrect Statements About Clark Wealth Partners

A customer should constantly be able to respond to "what takes place if something occurs to my Financial Expert?". It starts with due diligence. Always effectively vet any type of Financial Advisor you are pondering collaborating with. Do not count on promotions, honors, qualifications, and/or references entirely when looking for a connection. These methods can be made use of to narrow down the swimming pool no doubt, however after that gloves require to be placed on for the rest of the work.

when interviewing consultants. If a particular location of know-how is required, such as dealing with exec comp strategies or establishing up retirement for small company proprietors, find consultants to meeting that have experience in those sectors. When a connection starts, stay invested in the relationship. Collaborating with a Monetary Consultant must be a collaboration - retirement planning scott afb il.

It is this kind of effort, both at the begin and with the relationship, which will aid emphasize the benefits and ideally minimize the negative aspects. The function of a Financial Consultant is to help customers establish a strategy to meet the monetary objectives.

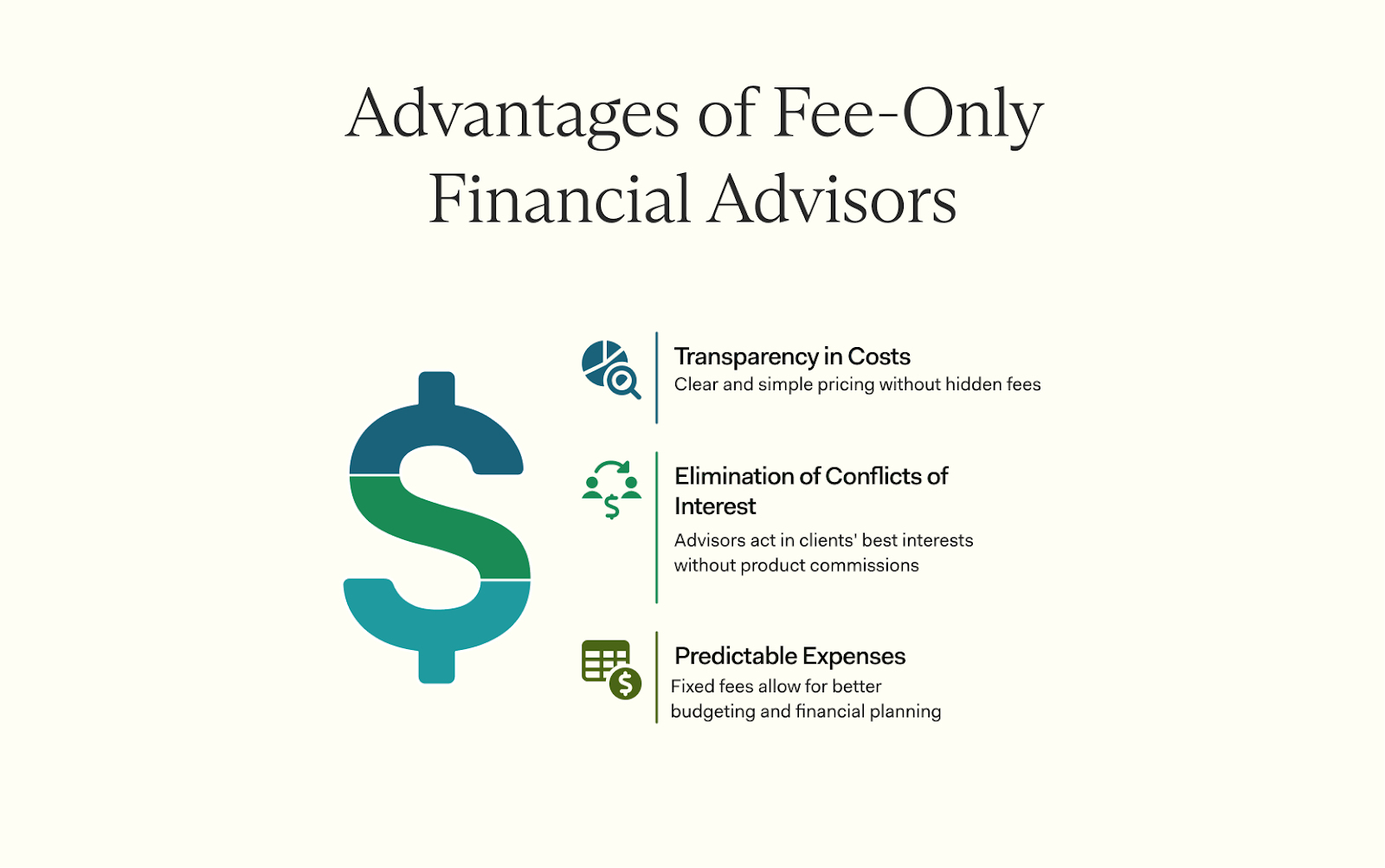

That task consists of costs, often in the forms of property management charges, compensations, planning charges, financial investment product fees, and so on - civilian retirement planning. It is essential to recognize all costs and the structure in which the advisor runs. This is both the duty of the advisor and the client. The Financial Advisor is in charge of giving value for the costs.

The Ultimate Guide To Clark Wealth Partners

Planning A service strategy is vital to the success of your business. You require it to know where you're going, just how you're obtaining there, and what to do if there are bumps in the road. A great monetary expert can put together a thorough strategy to help you run your company extra efficiently and get ready for anomalies that develop.

It's all concerning making the wisest financial choices to increase your possibilities of success. They can lead you toward the very best chances to raise your profits. Minimized Stress As a local business owner, you have great deals of points to fret about. A great economic consultant can bring you satisfaction knowing that your finances are getting the interest they require and your money is being spent intelligently.

Third-Party Perspective You are absolutely invested in your company. Your days are loaded with decisions and issues that impact your company. In some cases local business owner are so concentrated on the daily grind that they forget the huge photo, which is to make a revenue. A financial advisor will certainly check out the general state of your financial resources without getting emotions included.

See This Report on Clark Wealth Partners

There are numerous pros and disadvantages to take into consideration when working with a financial consultant. Advisors deal individualized approaches tailored to individual goals, potentially leading to much better financial end results.

The cost of hiring a financial advisor can be significant, with costs that may influence total returns. Financial preparation can be frustrating. We suggest speaking with an economic consultant.

It just takes a few minutes. Have a look at the experts' profiles, have an introductory contact the phone or introduction face to face, and select who to collaborate with. Find Your Expert Individuals turn to financial experts for a myriad of factors. The prospective benefits of working with an advisor consist of the know-how and understanding they provide, the customized advice they can supply and the long-lasting discipline they can infuse.

See This Report about Clark Wealth Partners

Advisors are experienced experts that stay upgraded on market fads, investment methods and economic laws. This understanding allows them to give understandings that may not be easily noticeable to the average individual - https://www.gamespot.com/profile/clarkwealthpt/. Their experience can assist you browse complicated economic circumstances, make educated decisions and possibly exceed what you would achieve by yourself